MobilePedia: World Class Mobile Marketing from Latin America

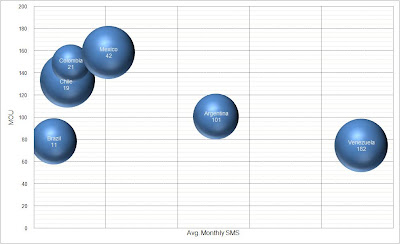

This week I attended the 2009 Latin America Mobile VAS Forum in Miami (June 8-10), with the participation of analysts, technology vendors and operators. The global economic downturn is, not suprisingly, on everyone's mind. This topic kept coming up repeatedly and the attendance to the event, about half of what we saw in previous years is also an indicator of the tough times we face. However, it was encouraging to interact with technology vendors and operators who remain optimistic about the future. In the next weeks I will add more posts about this meeting and the discussions I had both with operators and technology vendors. This week, I want to share my thoughts on a presentation by Marcelo Castelo of the Brazilian Agency F.biz. Marcelo's presentation, titled "The Mobile as a Mass Media Channel With Internet Characteristics: The Possibilities of the Mobile Marketing" focused on case studies in mobile marketing from Latin America. The case studies shared by Marcelo s