LATAM 2009: A Mosaic of Opportunities

"When we long for life without difficulties, remind us that oaks grow strong in contrary winds and diamonds are made under pressure." ~Peter Marshall

"When we long for life without difficulties, remind us that oaks grow strong in contrary winds and diamonds are made under pressure." ~Peter MarshallTechnology companies tend to view the Latin American mobile market as a single block; this might be in part because of the similarities in key demographic and economic factors including language, GDP and mobile penetration as well as the presence of two large players -Telefonica and America Movil- that dominate the region.

The Latin American mobile market, however, is incredibly complex. Each country shows remarkably different subscriber usage behavior patterns and adoption of technologies; this translates into different needs and consequently, different opportunities for each market.

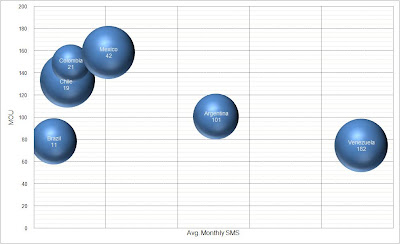

Opportunity Maps are particularly useful in analyzing and understanding these differences. The chart above shows three key factors: (x) Average Monthly SMS; (y) MOU - Minutes of Usage; and ARPU - Monthly Average Revenue per User (bubble size) for the six largest markets in the region; Brazil, Mexico, Chile, Colombia, Venezuela and Argentina.(1)

Some opportunities can come from increased MOU or SMS in countries that show low usage, introducing SMS based services in countries with low voice usage or new data services where usage and ARPU show potential for rapid adoption.

Some key differences stand out in the chart above:

- Mexico, Venezuela and Chile have a larger ARPU; Colombia and Brazil are on the lower end.

- Venezuela and Argentina show SMS usage above 100 messages per month; Brazil and Chile are almost in the single digits.

- Voice usage is significantly higher in Colombia and Chile and lower in Venezuela and Brazil.

The adoption of text messaging can be explained by a number of factors. In Colombia, the price war between operators a few years ago resulted in the launch of the "Pioneros" program by Ola (now Millicom/Tigo) with heavy discounts for voice. In countries such as Chile and Colombia, subscribers pay about the same for a text message and a phone call; this might explain why texting has not taken off.

Regulation also plays an important role; in countries like Venezuela and Brazil, the introduction of a regulation prompt for transfer to voice mail on busy/no answer advising callers that they will be charged for the call has resulted in increased slamdown and redial attempts. This impacts network productivity with a large number of calls generating traffic but no revenue.

From the map above, we can identify opportunities for call completion solutions that influence subscriber usage in countries with low MOU such as Venezuela and Brazil. This includes replacing voice mail with "A" party solutions such as availability notification for the calling party.

In countries such as Venezuela and Argentina, where SMS usage is high, there are opportunities for other forms of messaging such as Mobile Instant Messaging (GSMA PIM); subscribers are clearly using texting as a form of instant messaging.

This year operators have made it clear that they will have to limit CAPEX to a minimum to maintain healthy cash flows. Since the region is still expected to grow in number of subscribers, expanding capacity of existing network infrastructure will be their top priority. However, as the chart above clearly shows, there are other opportunities that operators can explore to increase revenue, despite the fact that subscribers are expected to curtail spending.

Some opportunities can be found in improving service and network productivity; i.e. increasing output using the same infrastructure or expanding capacity with minimal CAPEX. An added benefit is that some of these opportunities can be positioned as new services; this year operators will have limited resources but they cannot afford to miss opportunities to maitain or improve their position in the market.

For technology vendors, dealing with Latin America is becoming increasingly challenging; not only is the region incredibly complex, but the big players in the region -America Movil, Telefonica Movistar and Millicom- have consolidated their presence and gained negotiating power in the last few years.

Understanding the market and the specific needs and opportunities in each country, however, can help identify leads in Latin America, a market that is complex, fascinating and full of hidden opportunities.

(1) Source Pyramid Research, 2009

Hi Raul,

ReplyDeleteWorking for telecoms operators in Latam, I found very interesting your post.

Paulo